News

Find out the latest news and developments from across our business, projects and markets

-

20.10.2025

EcoSecurities Becomes a Certified B Corporation

-

23.09.2025

EcoSecurities wins again at the 2025 Environmental Finance Voluntary Carbon Market Rankings

-

23.04.2025

EcoSecurities and ESB Launch ‘Indonesia Sustainable Ride’ Program to Promote Electric Vehicle Uptake and CO2 Emission Reductions

-

26.02.2025

Blended finance offers the key to unlock transformational finance

-

05.11.2024

Join our network of experts for Nature-Based Solutions in Brazil

-

30.09.2024

EcoSecurities Launches New Brand

-

25.09.2024

EcoSecurities and KEPSA Announce Strategic Partnership

-

23.09.2024

EcoSecurities Wins 3 Categories in this Year’s Environmental Finance Voluntary Carbon Market Awards

-

30.07.2024

The canary in the coalmine moment for SBTi

-

30.07.2024

Accelerating Clean Energy Access in Africa by Unlocking the Catalysing Potential of Carbon Finance

-

16.07.2024

Carbon credits a ‘catalyst’ for climate action, not just a method to offset emissions

-

06.07.2024

To avoid or not to avoid?

-

05.07.2024

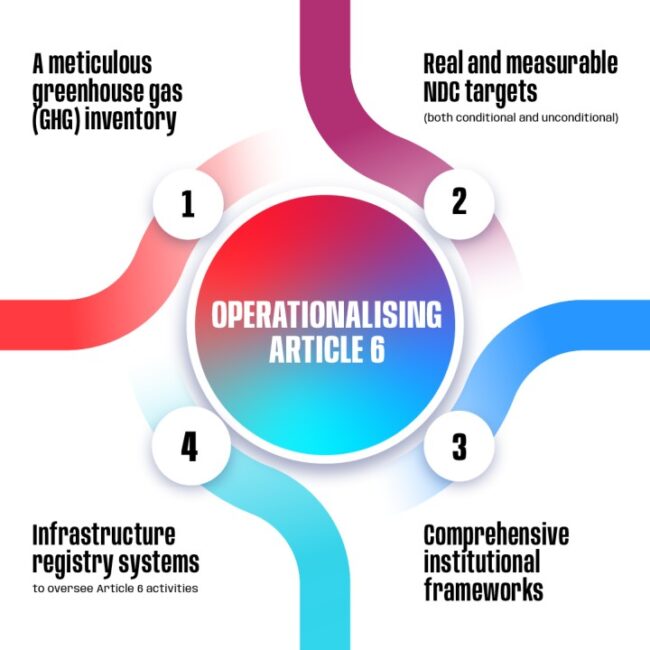

Can international climate sources and carbon markets work cooperatively to scale private sector capital? Yes, they can.

-

27.06.2024

COP29, Delivering on Climate Finance

-

14.05.2024

2024 Summit on Clean Cooking in Africa: Challenges and Opportunities

-

14.03.2024

RGWE and EcoSecurities Register 260 MW Wind Energy Project in Egypt